Over the last several months, some of the most common concerns I’ve been hearing among commercial real estate investors continue to revolve around inflation. With lumber costs hitting a 13-year high in May, overwhelming production delays, and labor shortages impacting industries around the globe, it’s not surprising to see a fair amount of uncertainty in the market.

With these factors in mind, I took the opportunity to join a panel of experts in presenting at a recent CCIM conference, which happened to be focused on this very issue of rising costs. It was a meaningful opportunity for me and my team to examine what is occurring in the market right now and do our best to interpret what these trends mean for us as investors. Below are 3 insights that I would urge everyone to remember as we transition into the next cycle.

- Costs are doing exactly what they have done since the beginning of time.

There is a reason that the Federal Reserve aims for an average inflation of 2 percent over the longer run—it makes for a healthy economy. When you look at how costs evolve over time, the reality is that the trend is almost always upward. Even pre-pandemic in a bolstering economy, prices were steadily increasing because when people have better jobs, they tend to feel more confident and are willing to spend more as a result. Then, as prices rise, people tend to expect inflation, and that expectation motivates them to spend more now to avoid future price increases. It is a cycle that has existed since the beginning of time, and it’s important to take a step back and acknowledge that unless we have some major event or significant interference, prices will always trend upward over the long-term. The truth is, I don’t foresee costs dipping back down to pre-pandemic levels any time soon, if ever.

- As inflation climbs, so do salaries.

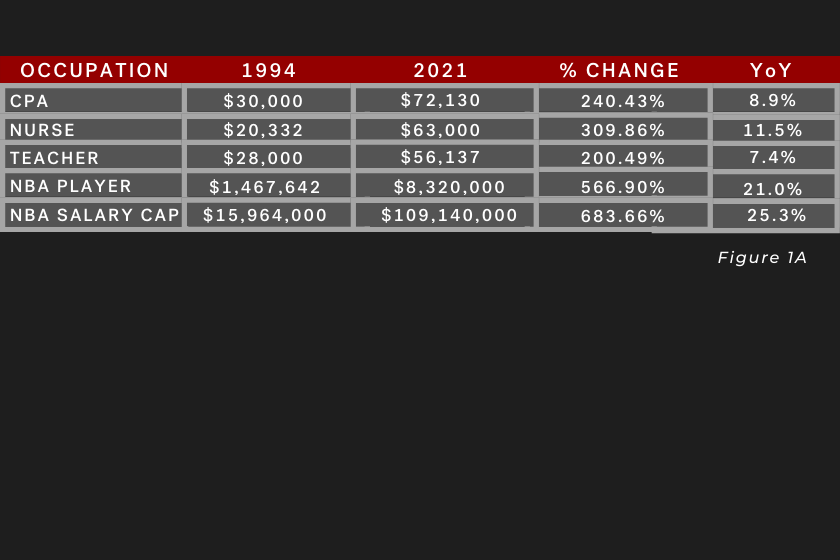

If you look at average salaries in Utah from 1994 to 2021, they show a steady year-over-year increase in every industry (see Figure 1A). In April, U.S. job openings grew to a record-high of 9.3 million, and naturally, the workforce shortage has only increased workers’ bargaining power. For example, according to the Bureau of Labor Statistics, the average hourly wage in the hospitality industry was $18.09 in May, up from $17.86 in April, and over the past three months, hospitality wages have risen at an annualized pace of 14.5%. “So long as the industries that are seeing the really rapid wage growth are also the ones seeing really rapid employment growth [which is true for hospitality right now], that actually doesn’t strike me as a shortage,” said Josh Bivens, Director of Research at the Economic Policy Institute. “That strikes me as how economies adjust to a big increase in demand,” he explained.

- There is safety in holding.

Successful real estate investment is not usually a get-rich-quick ploy. Instead, it’s a patience game. At PEG, we understand that, often times, holding and letting both inflation and real growth occur over time is the smartest way to go. There is great power in buying real estate at today’s pre-inflation prices, locking in good rates, paying for it over time, and then exiting when the time is right to maximize returns.

My best recommendation is to make investment decisions knowing that inflation will occur at some degree, but to avoid getting too wrapped up in concerns over it. At PEG, we underwrite conservatively and build contingencies into all of our business plans. We forecast for the long-term hold, and that cautious approach has worked well for our firm over the past 18 years. We feel confident in our strategies as we move into the next economic cycle and look forward to sharing some of our new exciting opportunities with you in the weeks to come.